How It Works?

Discover Your Trading Potential

Monetary Policies and Central Banks

Monetary policies and central bank practices play a critical role in the stability of the global economy.

Analysis of Global Economic Crises and Lessons Learned

The global economy has been shaken by major crises at different times throughout history.

Forex and Cryptocurrencies – Investment Portfolio Diversification

One of the most important ways to achieve long-term success in financial markets is to diversify your investment portfolio.

Why Klasfx?

Trading Platforms

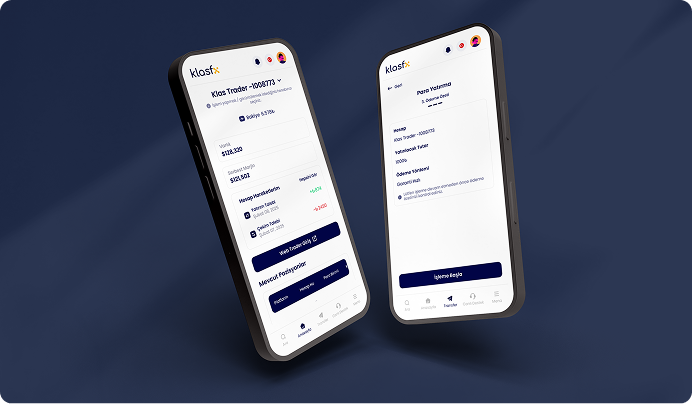

Download Our Apps to Track Forex Markets Anytime, Anywhere!

KlasFX Blog

Formations and Patterns in Forex Charts

Reading price movements correctly in the Forex market enables investors to make more informed decisions.

How to Make Short-Term Forex Transactions?

The Forex market offers attractive opportunities for short-term investors thanks to its high liquidity and 24-hour trading structure.

Advice for Those Starting Forex

Trump's media company is trying to raise $3 billion to invest in cryptocurrencies.